Want to know how much seller closing costs are in California?

If so, you’ve come to the right place.

We’re going to break this down in detail.

First, I’ll outline all of the seller closing costs in California. I’ll also run through examples so you can get an idea of what your estimated cost for each of these might be.

Then, I’ll show you all of this together so you can see what your total closing costs might look like when you sell your home in the Golden State.

By the time we’re done, you’ll get an excellent idea of your total estimated closing costs and how much you might walk away with.

What are the typical closing costs for sellers in California?

The costs at closing for the typical California home seller can be broken down into six categories:

- Real estate commissions

- Escrow fees

- Title insurance

- County transfer taxes

- City transfer taxes

- Miscellaneous items

Some of these closing costs are based on the county and city you live in.

Assuming you don’t owe more than what your California home is worth, all of your closing costs are paid out of your net proceeds, meaning you don’t pay anything out of pocket.

You’ll see these costs toward the end of your estimated closing date on a settlement statement.

This is a one-page document detailing the final selling price, your total closing costs, and your net proceeds.

I’ll show you what this looks like shortly.

California real estate commission

When you sell your home, you’ll pay a commission to your agent and potentially to the buyer’s agent (included in the buyer’s offer).

The agent commission will be a chunk of your costs.

The average total commission most home sellers pay in California is five to six percent of the final selling price (sometimes less for higher-priced homes).

Do you have to pay this amount?

Nope.

Real estate commissions are negotiable.

In fact, there are numerous options to pay lower real estate commissions in California. These include the following:

- Discount brokerage

- Flat fee company

- Selling without a Realtor

- Negotiating lower real estate commissions

But choosing a lower seller cost option can mean you risk sacrificing one or more of these from your real estate agent:

- Service

- Experience

- Marketing

- Negotiating

- Looking out for your best interests

How the commission works

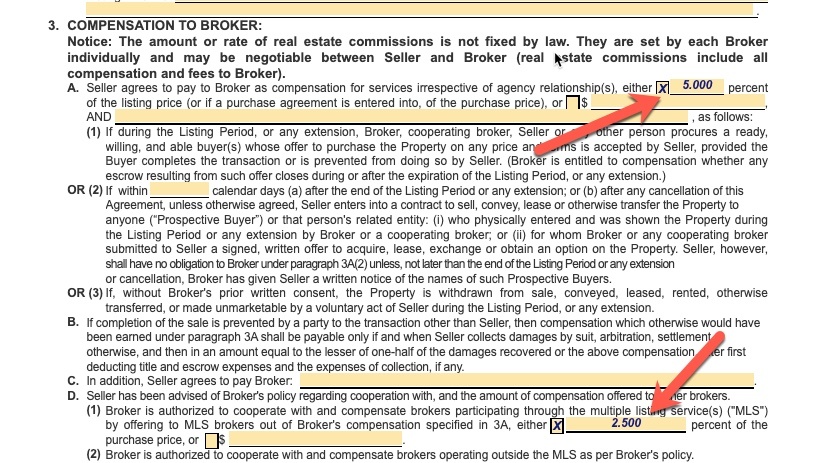

Let’s say you list at a five percent total commission. You’re technically paying the five percent commission to the brokerage and listing agent you sell with (this is how it’s worded in the listing agreement).

The total commission is usually split fifty-fifty between the brokerage you hire (the company your listing agent works for) to sell your home and the brokerage that the buyer’s agent works for.

This is detailed in the listing agreement you’ll sign with your real estate agent.

Here’s an example of what that looks like:

I’m not a CPA, so don’t take this as tax advice, but you should feel pretty confident that all of the real estate commissions are tax-deductible. Of course, I would make sure by confirming with your accountant.

Escrow fees In California

Escrow fees will be another part of your closing costs.

You might be asking, “what the heck are escrow fees and what is an escrow company?“. I won’t dive into the specifics of what an escrow company does, but here’s the short version:

An escrow company is a neutral third party between the seller and the buyer who holds the money until the home sale is final.

They are responsible for making sure that the buyer doesn’t receive the property and the seller doesn’t receive payment until everything is executed as agreed upon in the contract.

This isn’t the first thing that usually comes to mind when selling, but it is an important part of the overall closing costs a seller pays in California.

Ok, now that you know what an escrow company is, let’s talk about the escrow fees.

Escrow fees

For providing their services, the escrow company charges a fee. These are usually referred to as “escrow fees” on your settlement statement.

Depending on which county you’re in, you may or may not have to pay this. Each county has a preset “standard” of determining if the buyer or seller pays for this.

This will be detailed in the offer contract you receive from a buyer and is negotiable.

A rough calculation of the cost is $2.00 for every $1,000 of the sales price, plus $250.

So if your home sells for $1,000,000, and you live in a county that requires the seller to pay, you’ll pay an escrow fee of roughly $2,250. Most escrow companies charge around the same amount.

Here are a few examples of who typically pays for the escrow fees in California:

Alameda County: Buyer

Contra Costa: Buyer

El Dorado: Split 50/50

Fresno: Split 50/50

Los Angeles: Split 50/50

Orange: Split 50/50

Riverside: Split 50/50

San Francisco: Buyer

San Mateo: Seller

Santa Clara: Seller

Santa Cruz: Split 50/50

Ventura: Split 50/50

What is title insurance?

Title insurance is an insurance policy that protects the buyer from a financial loss due to defects on the title. An example of this is someone claiming ownership of the property after it is sold.

It can also protect against liens that might pop up during or after the real estate transaction closes. Sometimes in the process of selling a property, it can turn out that more people have a right to ownership than previously thought. Potential unpaid debt that the seller may have had might also come up after the home sale closes. Title insurance works to protect against all of this.

In most real estate transactions, there are two title insurance policies: one that covers the buyer and another that covers the buyer’s lender. If the buyer is obtaining financing, this policy is required.

The policy that covers the buyer is usually referred to as an owner’s title policy. The policy that covers the buyer’s lender is typically called a lender’s policy.

Title insurance cost in California

Unlike escrow fees, there isn’t a set calculation to determine the cost of title insurance.

We’ve found that title companies in California usually charge around the same price. To get an idea of what this is, take the sale price and multiply it by .00225.

For example, if your final selling price is $1,100,000, then the cost for title insurance might be $2,475. The cost can vary depending on your final selling price.

You can use this free title insurance calculator to get a more accurate estimate.

Unless they ask the home seller to cover some or all of their closing costs, the buyer will pay for the lender’s policy.

Who pays for the owner’s title policy (the policy that protects the buyer) can also vary by county.

California transfer tax

Part of the closing costs for a seller in California is city and county transfer taxes. These are also referred to as “documentary transfer taxes”.

What exactly is a documentary transfer tax?

Think of it this way. Every time a property changes ownership, the local governments want a piece of the pie.

County transfer taxes

Every county in California has a transfer tax.

The cost of the county transfer tax in California is $1.10 for every $1,000 of the sale price, except for San Francisco County.

So if your house sells for $1,000,000 and your property is not located in San Francisco County, then the county transfer tax would be $1,100.

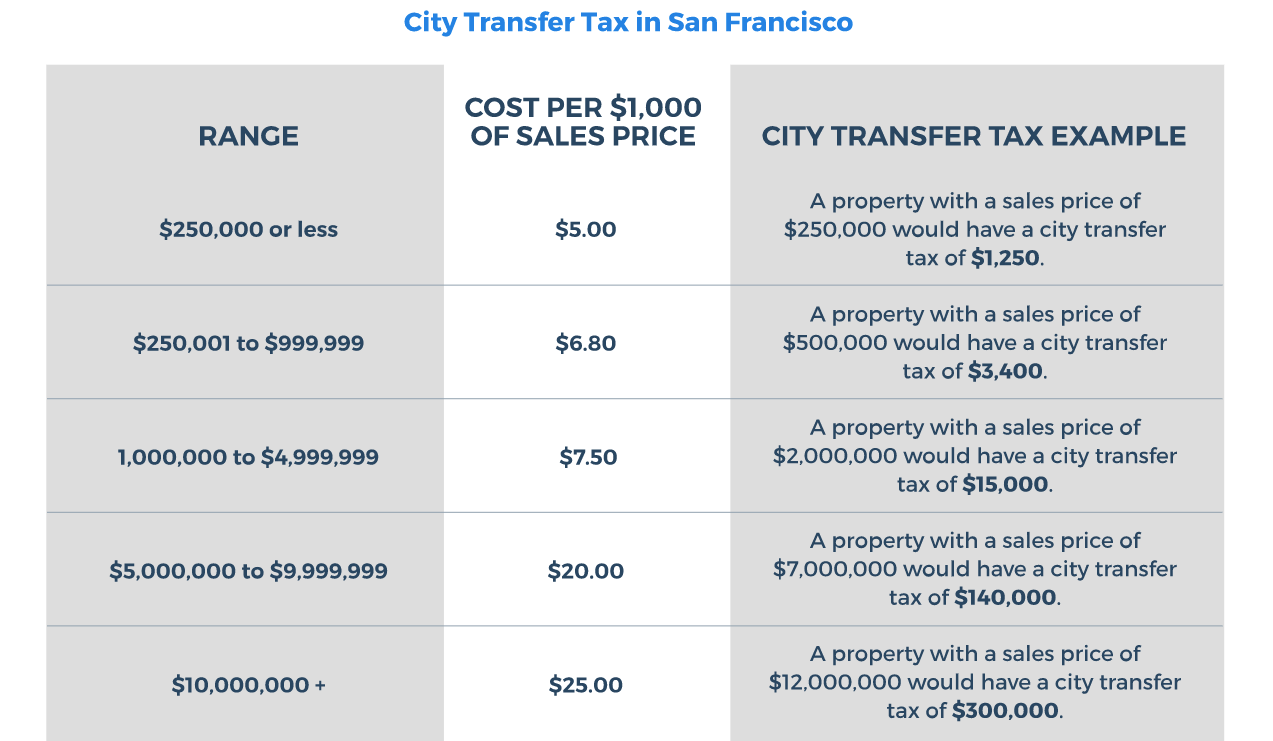

San Francisco’s transfer fees or taxes operate under its own unique calculation. Here’s how it works…

City transfer taxes

Not all cities in California have a documentary transfer tax. For example, in Santa Clara County, the only cities that have a city transfer tax are San Jose, Palo Alto, and Mountain View.

The cost of the city transfer tax in these three cities is $3.30 for every $1,000 of the sale price. On a home that sells for a million dollars, this comes out to $3,300.

The cost of city transfer tax can vary for each city.

Who pays for these documentary transfer taxes?

Similar to the escrow and title fees, city transfer fees can vary by area. In almost every scenario, the seller will either pay both or these costs will be split fifty-fifty between the buyer and seller.

Miscellaneous Fees

You might see several miscellaneous fees itemized on your settlement statement.

Some of these include the following:

- Recording fee

- Notary fee

- HOA fee (if the property has an HOA)

- Any reports and/or inspections (including home inspection fees) that are not paid upfront

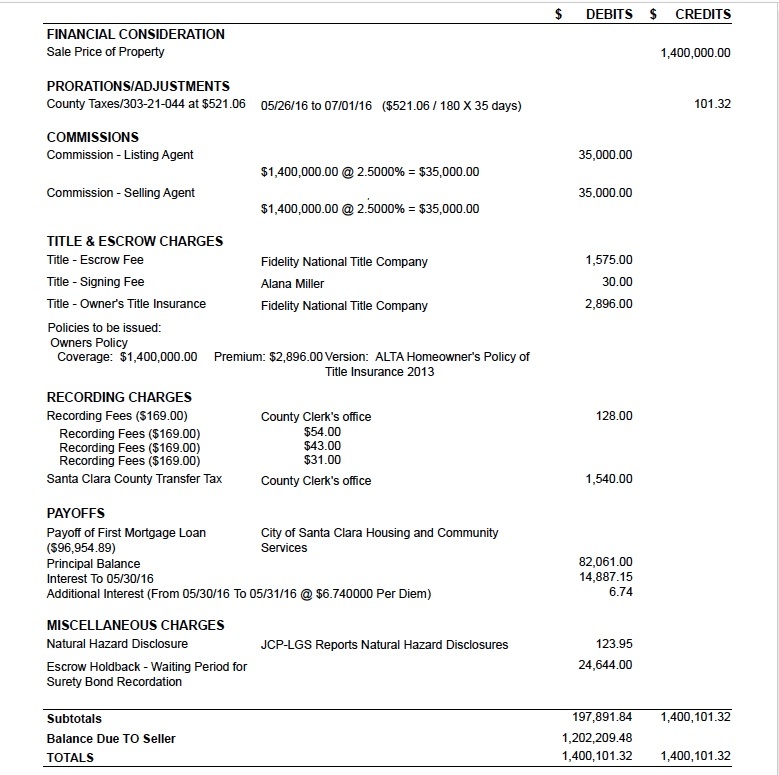

Ok, as promised, here’s an example of a settlement statement detailing the closing costs for a seller in California.

You’ll notice on this settlement statement that the seller’s pro-rated amount for their county taxes and mortgage payoff is included.

And you’ll see the same on yours.

These aren’t necessarily costs, but they are itemized with your closing costs on your final settlement statement.

Conclusion

Now that we’ve gone through each closing cost you might see as part of your total cost, let’s quickly recap…

What are the closing costs for a seller in California?

- Real estate commissions

- Escrow fees

- Title insurance

- County transfer taxes

- City transfer taxes

- Miscellaneous items

How much are seller closing costs in California?

- Real estate commissions = 5% (can be higher or lower)

- Escrow fees = $2.00 for every $1,000 of the final sale price + $250

- Title insurance = sale price x .00225%

- County transfer tax = $1.10 for every $1,000 of the final sale price

- City transfer tax = the costs depend on the city you live in

- Miscellaneous items = varies for each transaction

Selling a home in California is a big financial transaction.

Knowing what to look for in the agent you select can help you reduce your costs by maximizing your proceeds.

Hopefully, this gives you a better idea of what your total closing costs might look like.

If you’d like to see numbers specific to your sale, you can try our California seller closing costs calculator.