Setting the right price before listing your home is crucial.

This is why many homeowners fear setting their asking price too low and leaving money on the table.

That anxiety may lead you to contemplate whether you should get an appraisal before selling your house.

After all, an appraisal gives you a straightforward idea of what your home is worth, right?

Not exactly.

A pre-listing appraisal is not the best approach to setting a competitive listing price.

But there are a few exceptions. (I’ll tell you what they are.)

I’m going to share my opinion about why you should probably not get an appraisal before listing your home –– and what you can do instead.

Let’s jump in.

Why an appraisal is needed in a real estate transaction

An appraisal is used in a home sale to verify that the property’s value matches or exceeds the purchase price.

Think of an appraisal report as a required condition in order for the buyer to obtain a mortgage.

The property is the collateral for the buyer’s loan.

So the buyer’s lender wants to ensure that the asset they’re lending on is worth what the buyer is paying for it.

The lender will order an appraisal shortly after the purchase contract is ratified.

And the real estate appraiser will conduct a formal review of the home based on an industry-standard appraisal process (which we’ll go over below).

The appraiser’s evaluation is also used to determine the buyer’s interest rate.

That’s because interest rates can fluctuate based on the buyer’s loan-to-value ratio (loan amount divided by the appraised value).

So while a formal assessment of the home’s value is required by the buyer’s lender –– it doesn’t serve the same purpose for a home seller.

How appraisers determine the value of a home

Understanding how an appraiser determines a home’s value will help you see how their approach differs from a better solution.

Here’s an overview of the steps a residential real estate evaluator takes to arrive at the value of a property.

Visit the property

An appraiser will schedule a visit to the home shortly after receiving a service request.

They’re typically at the property for 30 minutes or so (depends on the size of the home).

Their goal is to inspect the property and gather the information they need to complete their valuation.

Here’s what they typically do at the house:

- Take photos of the interior and exterior

- Measure the interior square footage

- List any notable improvements and amenities

- Note any surrounding features of the property

- Document any proximity to road noise.

Keep in mind that an appraisal is not the same as a home inspection.

An appraiser visits a property to determine its value.

Meanwhile, a home inspector visits a property to inspect its general condition.

Determine comparable sales

Finding recently sold homes that are similar to the subject property is an important part of the appraisal process.

The key word there is “similar.”

Why?

Because the more similar the comparable homes are, the more likely the appraised value will align with market value.

Usually, an appraiser will use the following criteria when searching for comparable sales:

- Closest in interior square footage

- Most recently sold

- Closest in proximity.

The appraiser doesn’t have to physically inspect the comparable homes.

But they do need to visit each property, photograph it from the street, and compare key MLS data from each recent sale to the subject property.

Typically, appraisers use Fannie Mae’s Uniform Residential Appraisal Report.

This documented assessment requires the use of at least three comparable sales to support the property valuation.

Make price adjustments

The appraiser’s next step is to compare features and characteristics between the subject property and each comparable home.

The goal of this is to adjust the price of the subject property based on the key differences.

Those differences can include:

- Interior square footage

- Bedrooms

- Bathrooms

- Lot size

- Condition

- Age

- Heating and cooling type

- Proximity to road noise.

There’s a price adjustment assigned to each of these.

For instance, if the subject home has an extra bedroom compared to a comparable property, the appraiser will make a positive adjustment to the sale price of the comp.

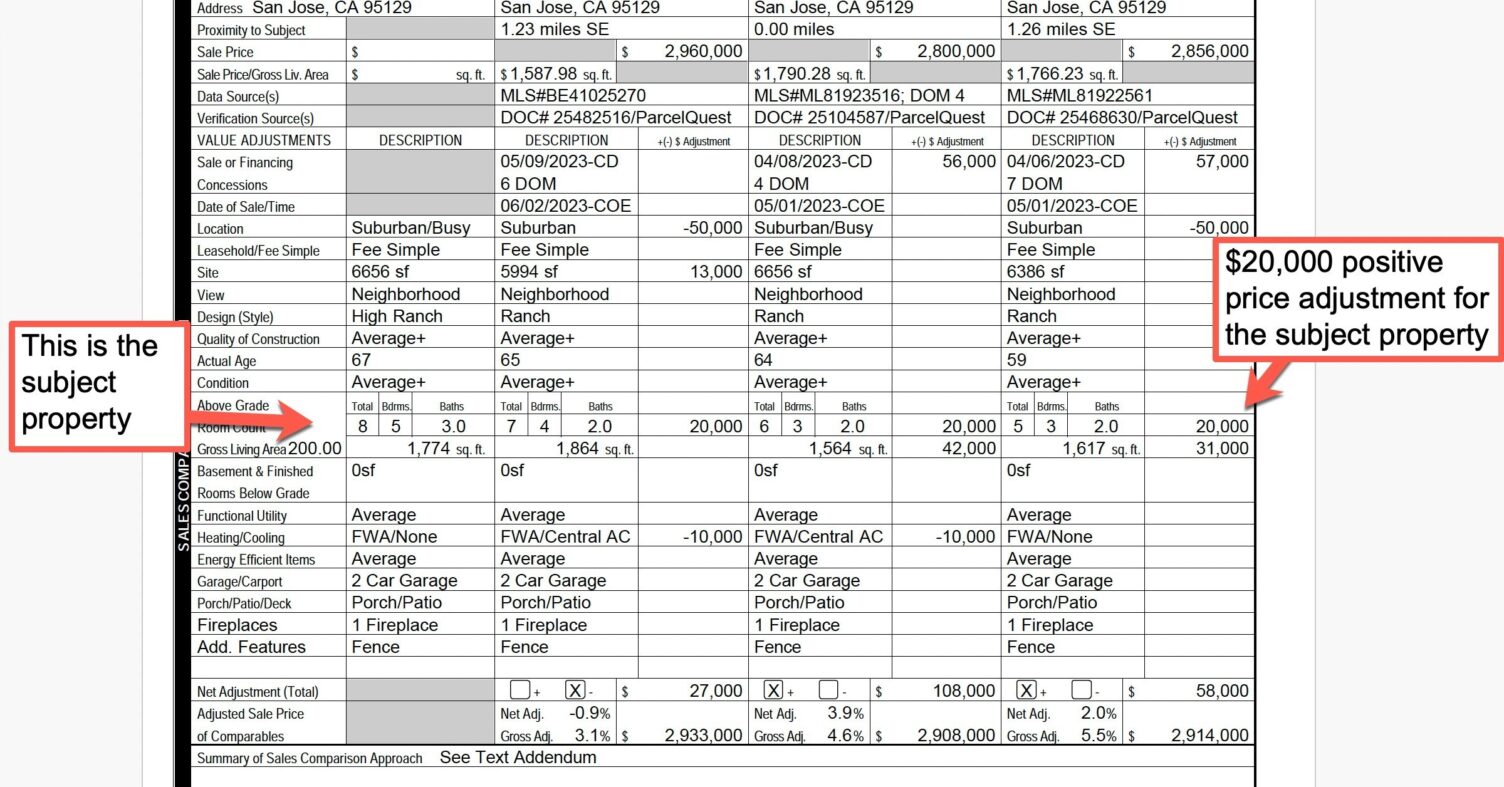

You can see how this works in practice in the screenshot below.

You’ll see that the appraiser added $20,000 to the comparison value of comp #1 to adjust for the extra bedroom of the subject property.

Exact value adjustments are based on specific parameters and may vary somewhat among different appraisers.

That’s because a property appraiser needs to adhere to a structured set of rules.

And they can apply subjective criteria within those rules.

Determine the appraised value

The last step is for the appraiser to arrive at their assessed value of the home.

They do this by:

- Adding or subtracting the assigned values of each comparable sale to arrive at the “comparison value”

- Considering current local market trends

- Factoring in the comparison price of each comparable home to arrive at the final value.

There’s no exact formula for this part of the process –– but many appraisers will sum up the comparison value for each comp and then divide by the number of comparable sales.

For example, let’s say an appraiser used four comps and arrived at the following four comparison values:

- $780,000

- $793,000

- $812,000

- $832,000.

The final value of the home being appraised might be $804,250 ($3,217,000 divided by 4) or somewhere close to this number.

Drawbacks to getting an appraisal before selling your house

Now let’s answer the question you want to know…

Should I get my house appraised before selling?

Here are three key reasons why most homeowners should not get an appraisal before listing a home for sale.

Misleading list price guidance

The biggest problem with having your home appraised before selling is that it can be the sole reason why you set the wrong listing price.

I know…

You’d think that getting an objective opinion of your home’s value from a residential appraiser would do the opposite.

But here’s the problem…

The price adjustments appraisers make when comparing one property to another do not always reflect what prospective buyers value in your market.

Let’s take a look at an example…

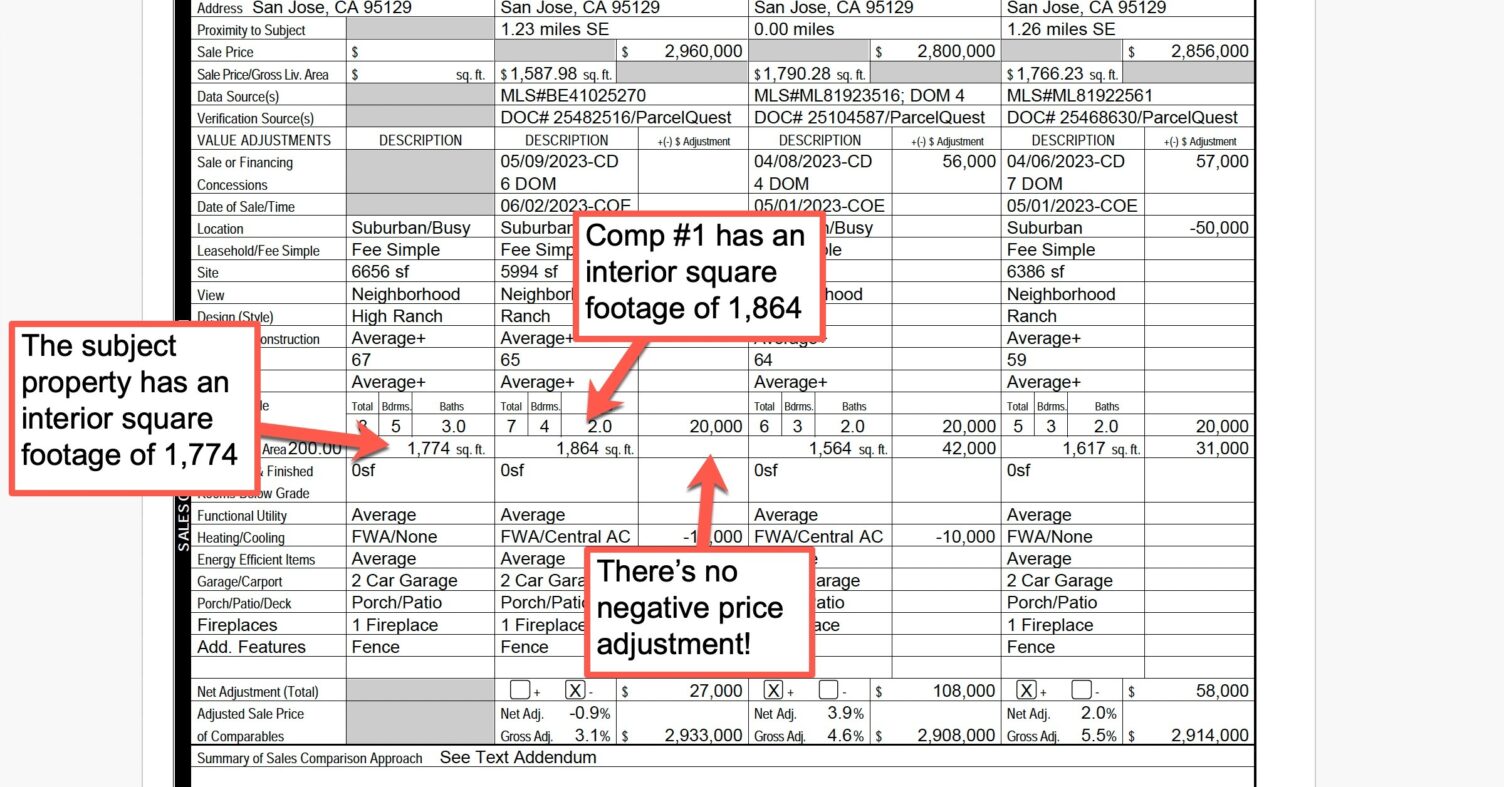

You can see in the screenshot below that the subject property’s square footage in this appraisal is 1,774.

And the square footage of the first comparable is 1,864.

That’s a difference of 90 square feet.

But where’s the value adjustment?

There isn’t one!

That appraiser thought the discrepancy in square footage didn’t warrant a difference in value.

I can guarantee that a good buyer’s agent would advise their client to consider this difference when making an offer on the home.

Now imagine you get an appraisal before selling your home.

And you use the appraised value to guide you on your “asking price.”

But you discover later that the appraiser didn’t make the right price adjustments to your house.

So you price your house lower or higher than you should, setting yourself up to receive lowball offers.

This is how an appraiser’s cookie-cutter approach can mislead you into setting an asking price that sabotages your listing.

And why the right price adjustments are key to knowing how to price your home for sale.

Prolong your time on the market

Having an appraisal done before selling your home could be why your house lingers on the market.

How?

Because the value that a real estate appraiser says your home is “worth” can put you at risk of being stubbornly stuck on that number.

Consider this scenario…

Let’s say you get a pre-listing appraisal and the value comes in at $500,000.

But you decide to be cautious and list your home for $475,000.

You get an offer from a buyer for $460,000.

However, you’ve still got $500,000 stuck in your head.

So you think countering the buyer’s offer at $470,000 is fair.

The result?

A serious and well-qualified buyer walks away.

They did their homework and accounted for key differences between your home and the right comps, which the appraiser overlooked.

Your house stays on the market and buyers start to wonder why it’s not selling.

The next offer you receive is for $450,000.

You’re stressed and don’t want to take another risk –– so you accept the lower offer.

Believing your house is worth more than it is can lead to overpricing and reluctance to negotiate a fair market value.

Not getting a pre-listing appraisal can help you avoid these scenarios.

Extra expense

According to the National Association of Realtors, a typical home appraisal costs $500.

But the price can range from less than $300 to over $800.

The variance in cost depends on your location and the size of your house.

That’s money you could put toward something more valuable when going through the steps to get your house ready to sell.

For example…

You could replace an appraisal with a pre-listing inspection.

Unlike an appraisal, getting a home inspection before selling is beneficial.

You can also allocate the funds for repairs needed to complete your seller’s home inspection checklist.

Some other ideas?

Enhance your curb appeal.

Touch up paint.

Hire a handyman.

Get new bathroom fixtures.

Or spend the money on other improvements to enhance your property’s appeal.

You could also shift the cost of an appraisal to moving expenses.

Here’s the point…

The money spent on a pre-listing appraisal could be more beneficial if used elsewhere in the home-selling process.

Reasons to get an appraisal before selling

Here are a few exceptions where having your home evaluated by an appraiser prior to selling it could make sense.

The property was inherited

In many cases, getting an appraisal before selling an inherited house is required.

But a pre-listing appraisal for an inherited home could still be beneficial even when a formal property value assessment isn’t necessitated.

For instance, you may live outside of the area and not know much about the local market conditions.

Or there may be a risk of dispute between beneficiaries.

Getting an appraisal of the house could help alleviate these problems.

You’re going through a divorce

Getting a property evaluation can also be valuable when you’re selling a house because of a divorce.

This is especially true if both spouses can’t agree on a real estate agent –– or if one spouse doesn’t trust the other to choose the right professional.

A pre-sale home appraisal can prevent one party from assuming biased decision-making.

And it can also come in handy if one spouse decides to keep the property after initiating the selling process.

The appraisal report allows both parties to see an unbiased evaluation from a neutral third party.

And that neutral opinion can help them decide on a reasonable price so they can divide assets fairly.

The home has unique features

Some homes just aren’t easy to value.

In most cases, that’s because there aren’t any comparable sales with the same unique selling features.

Those features might include:

- A large lot that’s not in a rural area

- Waterfront views

- A home with an additional dwelling unit

- Unusual amenities such as a wine cellar.

You and your real estate agent may land at polar opposites on the value of these or other unique items.

So getting an appraisal before listing can give you a more objective starting point for pricing.

This is especially important since setting the right price is one of the key steps to selling a house.

Appraisal vs. CMA

An appraisal isn’t the only way to get an estimated value of a house.

A comparative market analysis (CMA) can also provide an assessment of a home’s valuation.

Real estate agents will generally provide a prospective home seller with a no-cost CMA.

It’s the agent’s opportunity to give their opinion about what they think the home is worth and why.

The primary difference between an appraisal and a CMA?

An appraisal is constrained by strict industry parameters, which may not accurately reflect what a buyer is willing to pay for a property.

However, a comparative market analysis is not bound by these rigid standards, allowing a real estate agent to provide a more precise assessment of how much a buyer might offer for a home.

In other words, a CMA in real estate gives an agent more flexibility to determine a home’s market value.

And that flexibility can lead to a more accurate evaluation of the property’s price tag.

For instance, in a high-priced area where AC is desirable to buyers, an appraiser may be required to cap the value of an AC unit at $10,000.

But a good agent may know it’s really worth $30,000+.

Or an appraiser might not adjust their value downward for a home with an undesirable layout (most appraisers don’t).

But a good real estate agent knows that an undesirable layout can have a big impact on buyer desirability –– so they will factor this into their CMA.

An appraisal and a CMA both use comparable sales and an overview of the property being assessed to determine its value.

They just arrive there through different processes.

In a nutshell, here are the key differences between an appraisal and a CMA:

| Appraisal | CMA | |

| Cost | $400–$800 | Free |

| Timeline | 1–4 weeks depending volume of appraisals | 1–3 days |

| Responsible party | A third-party appraiser | Realtor |

| Point of view | Rigid industry parameters | Potential buyers’ priorities |

Why choose a CMA over a pre-listing appraisal?

OK, I know what you’re thinking by now: “What should I do if I don’t get a pre-listing appraisal?”

If you haven’t already guessed…

You should get a comparative market analysis.

Because choosing a CMA over a pre-sale appraisal can prevent you from mispricing your house and becoming fixated on a single number during negotiations.

A CMA is also free and quicker to get.

Ultimately, obtaining a price opinion from a professional is one reason why you need a realtor to sell your house.

But not just any realtor.

Your CMA needs to come from a highly qualified agent who has a reputable track record.

Why?

Because they’re more likely to:

- Pull the right comps

- Compare the right property features

- Make the right price adjustments

- Not intentionally misguide you on price.

All four are key to arriving at the right list price.

Especially the last one.

Some listing agents are very good at tricking a seller into thinking that their house is worth more or less than it really is.

So you need to ensure that an agent you’re considering isn’t intentionally misrepresenting their CMA.

You can do this by verifying that they have the right qualifications.

And I’m not just talking about experience.

Your CMA should come from an agent who also has a history of:

- Only representing the seller when selling a home (and not the seller and the buyer in the same sale)

- Letting a seller cancel the agent agreement at any time, without owing any commissions.

These are the agents who are more likely to provide you with an accurate CMA (and look out for your interests).

And an accurate CMA increases your chances of selling your house faster and for a higher price.

That’s one reason why those qualifications are part of our unique agent screening requirements.