Most buyers and sellers prioritize the price when buying or selling a home.

Is the sale price important?

Absolutely.

But one aspect people often overlook is the contingency clauses in a purchase contract.

Contingencies are the number one reason for a home sale falling through after the seller has accepted the buyer’s offer.

The problem?

Many buyers and sellers dive into a real estate transaction without understanding what contingencies are or how they work.

That’s a mistake you want to avoid.

Why?

Because overlooking them can cost you more than you think.

Here’s what you need to know about real estate contingencies — and how to protect yourself.

What are contingencies in real estate?

A real estate contingency is a condition written into a purchase agreement that must be met for the sale to close.

These clauses make the contract dependent on certain events.

Common examples include the buyer securing financing or the home appraising at or above the sale price.

In plain terms, a contingency gives one party (usually the buyer) the right to walk away from the sale if a specific requirement isn’t satisfied.

And until those conditions are resolved, the deal can’t move forward.

Think of contingencies as safety nets.

They protect buyers from committing to a home with hidden issues or financing problems.

And they give sellers a clear framework for what needs to happen before closing.

How contingencies work in a real estate transaction

Contingencies follow a step-by-step process that begins the moment a buyer makes an offer.

Here’s how they work.

1. The buyer includes contingencies in the offer

The buyer decides whether to include contingencies when submitting an offer on a home.

If they do, those terms must be outlined in the purchase agreement.

This includes which contingencies they’re adding and how much time they’ll need to meet each one.

Most buyers lean on their real estate agent for guidance.

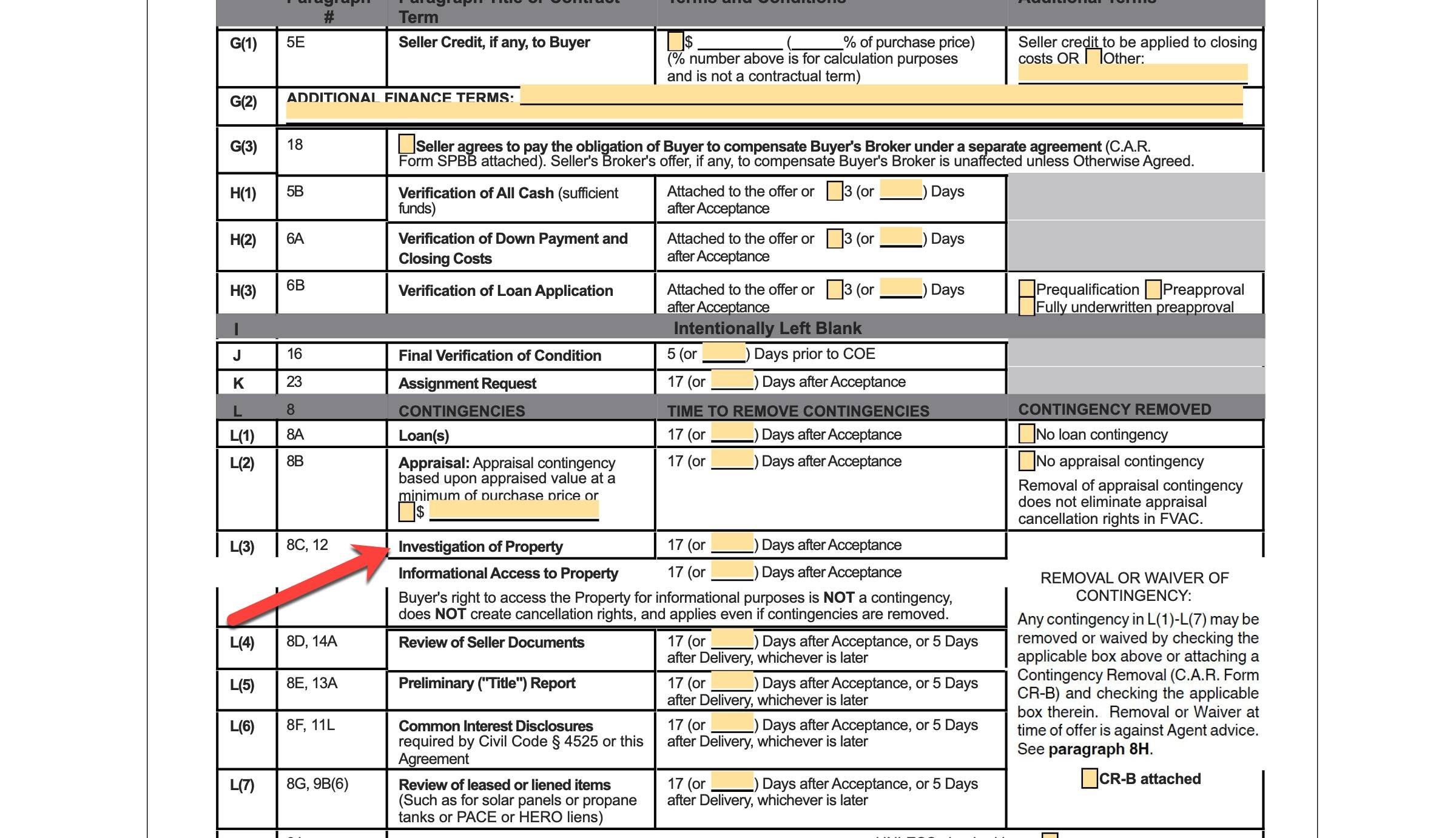

In many states, the standard real estate contract includes default timelines for each contingency.

But those deadlines can be changed.

For example, a contract might default to 17 days for the inspection contingency.

But a buyer could shorten that to 10 days to make their offer more appealing to the seller.

2. The seller reviews and negotiates the terms

Once the buyer submits an offer, the seller can accept it, reject it, or respond with a counteroffer.

They may ask the buyer to remove a contingency or shorten the timeline to meet it.

The buyer can also respond by accepting, rejecting, or countering the seller’s request.

A good real estate agent will guide the seller through these negotiations.

The sale becomes “contingent” once both parties agree to the terms and sign the contract.

At that point, the buyer typically deposits their earnest money into escrow.

3. Contingency deadlines must be met or removed

Each contingency has its own deadline as agreed upon in the contract.

The buyer must either satisfy each condition or remove it in writing before the due date.

For example, a buyer and seller might agree to a 10-day inspection contingency and a 14-day appraisal contingency.

If the buyer is satisfied with the inspection, their agent will submit a contingency removal form by day 10.

But if the appraisal isn’t complete by day 14, the buyer risks breaching the contract.

That is, unless the seller agrees to an extension.

What happens if a contingency isn’t met?

The seller has options if the buyer doesn’t remove a contingency by the deadline.

They can grant an extension or issue a Notice to Perform.

This is a formal real estate document that gives the buyer a short window (usually 48 hours) to take action.

If the buyer still doesn’t act, the seller can cancel the contract and relist the home.

But mediation could delay the sale if there’s a dispute over how the contingency was handled.

That’s especially common when both sides claim the right to the buyer’s earnest money deposit.

Why contingencies are important

Contingencies are a form of protection and leverage for both the buyer and the seller.

For buyers, contingencies provide a safety net.

They can walk away from the deal if a specific condition isn’t met — without losing their earnest money deposit.

But once their contingencies are removed, that protection disappears.

In other words…

The buyer’s good faith deposit is at risk if they want to back out of the sale after removing all contingencies.

For sellers, having the buyer remove all contingencies marks a major milestone in the home selling process.

It shows that the buyer is committed and the transaction is on a clear path to closing.

Fewer contingencies in a real estate contract means a stronger, more reliable deal.

That’s why both sides should understand exactly what’s at stake.

Because knowing when and how contingencies apply — and when they’re removed — can impact everything from timelines to negotiation power.

Common real estate contingencies

Here are the most common contingencies you’re likely to encounter in a real estate transaction.

Inspection contingency

Most people hear “inspection contingency” and think “home inspection.”

And that’s not wrong.

But it’s only part of the picture.

A home inspection is just one type of inspection a buyer can schedule during this contingency period.

The inspection contingency gives the buyer the right to inspect the property for any reason — not just the basics.

That could include inspections for:

- Termite or pest damage

- Roof condition

- Pool equipment

- Chimney safety

- Foundation issues.

It’s also a time for buyers to complete any other due diligence they feel is necessary.

In many states, this clause is actually labeled as an “investigation of property” in the purchase contract.

Here’s an example of that.

Maybe a buyer wants to bring in a contractor to estimate remodeling costs.

Or they may want to check city permits on past renovations.

No matter the reason, this is the buyer’s window to fully evaluate the property.

Appraisal contingency

Most mortgage lenders require buyers to get an appraisal when purchasing a home.

Why?

Because the property serves as collateral for the buyer’s loan.

And the lender needs to confirm that it’s worth the purchase price.

In many cases, the appraised value matches or comes close to the agreed-upon sale price.

That’s partly because the appraiser knows the sale price before visiting the property.

But sometimes, the appraisal comes in low — below the contract price.

When that happens, the lender will base the loan amount on the appraised value, not the sale price.

That shortfall means the buyer has to either increase their down payment or make up the difference another way.

This is where the appraisal contingency becomes critical.

It gives the buyer two key options if the home doesn’t appraise:

- Back out of the sale and recover their earnest money deposit

- Try to renegotiate the purchase price with the seller.

In either case, the contingency protects buyers from taking on more financial risk than planned.

Financing contingency

Many buyers get pre-approved for a mortgage before making an offer on a home.

A pre-approval letter from a reputable lender is a strong first step — but it doesn’t guarantee final loan approval.

That’s where a financing contingency (also called a mortgage contingency) comes into play.

This clause protects the buyer if they’re unable to secure a loan after the home goes under contract.

Once the offer is accepted, the buyer’s loan officer submits their documents to underwriting to begin the full approval process.

In most cases, well-qualified buyers are approved without issues.

But sometimes, financing falls through — due to a job change, credit issue, or something uncovered in underwriting.

If that happens, the financing contingency gives the buyer the right to cancel the contract and keep their earnest money deposit.

It’s not uncommon for a buyer in a strong financial position to waive this contingency.

But for others, it’s an important safeguard if the loan doesn’t go as planned.

Home sale contingency

Some buyers need to sell their current home before they can buy a new one.

In these scenarios, they’ll make an offer contingent on the sale of their existing property (also known as a home sale contingency).

Sellers generally see these offers as less desirable.

Why?

Because there’s a major hurdle.

The buyer must find a new owner for their current home before the transaction can move forward.

But not all home sale contingencies carry the same level of risk.

There are two common types — and one is more appealing to sellers than the other.

Sale and settlement contingency

This clause means the buyer’s current home is either:

- Not yet listed on the market

- Listed, but hasn’t received an offer.

The sale is contingent on the buyer both finding someone to purchase their current home and closing the deal.

That adds a lot of uncertainty.

This is why most sellers are hesitant to accept this type of offer unless their listing has been sitting on the market for some time.

Settlement contingency

This clause means the buyer already has a ratified contract on their home but the sale hasn’t closed yet.

It protects the buyer in case their current deal falls through before closing.

While still a risk to the seller, it’s a smaller one.

Because the buyer is further along in the selling process.

Title contingency

A title contingency protects the buyer by ensuring the property has a clear title.

That means making sure it’s free of liens, ownership disputes, or legal issues.

In some cases, the seller provides a preliminary title report up front.

This is typically provided by the escrow company or title company handling the transaction.

This report outlines key information about the property, such as:

- Current legal owner(s)

- Easements or encumbrances

- Mortgage liens

- Tax liens

- Mechanic’s liens (from contractors)

- Pending legal claims.

But not all buyers receive this report before making an offer.

And even when they do, the report may be outdated or incomplete.

The title contingency gives the buyer time to investigate the property’s title through a formal title search.

If issues are uncovered — like unresolved liens or unclear ownership — the buyer can request that the seller fix them.

If the issues can’t be resolved, the contingency allows the buyer to back out of the sale without losing their earnest money.

HOA contingency

The buyer is required to review and accept the HOA’s legal documents when purchasing a property in a homeowners association (HOA).

These documents are often several hundred pages and typically include:

- Monthly and annual HOA fees

- Restrictions on rentals, pets, property use, and alterations

- Upcoming or potential special assessments

- Financial statements and budgets

- Governing documents, including bylaws, CC&Rs, and the master insurance policy.

An HOA contingency gives the buyer a defined period (often several days) to review these materials.

And it allows them to cancel the contract without penalty if they’re not comfortable with the rules, restrictions, or financial health of the association.

The bottom line

Contingencies in real estate can have a big impact on the sale of a home.

The price is almost always the top priority for both the buyer and seller, but contingencies come in a close second.

They often determine whether the sale moves forward or falls apart.

That’s why understanding what they are and how they work is key to a successful transaction.

And if you’re planning to sell — or already reviewing an offer — it’s important to know where contingencies fit into the overall process of selling your house.